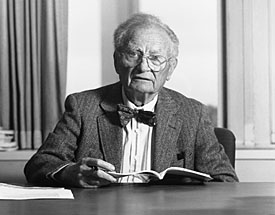

Professor Aizenman assigned a paper written by Paul Samuelson in 2004. As the professor pointed out, Samuelson is still productive while enjoying his retirement. It is really amazing to observe that many great economists are still contributing to the society when they are well into their 90s. Two of the economists that I admire most, Milton Friedman and Paul Samuelson, were both born in 1910's. Both of them are great in many ways. Friedman inspires me to become an economist. I read his autobiography over and over. Personally I don't like Samuelson's ideology, but enjoy reading every bit of his Principles of Economics. Many economics professors opt for more modern treatment of economics as their textbooks, but I think Samuelson's is so classic that no one economics major should miss it. Besides, the more economics I study, the more versatile I find in Samuelson. That guy is every where!

My classmate Ambrish is always amazed at the longevity of great economists. Well, here is my theory. Economists study rational behaviors of human beings. They themselves should behave rationally, too. Consequently, they eat "rationally", act "rationally", and exercise "rationally". On average, if they live rationally, they will live longer!

(picture: web.mit.edu)